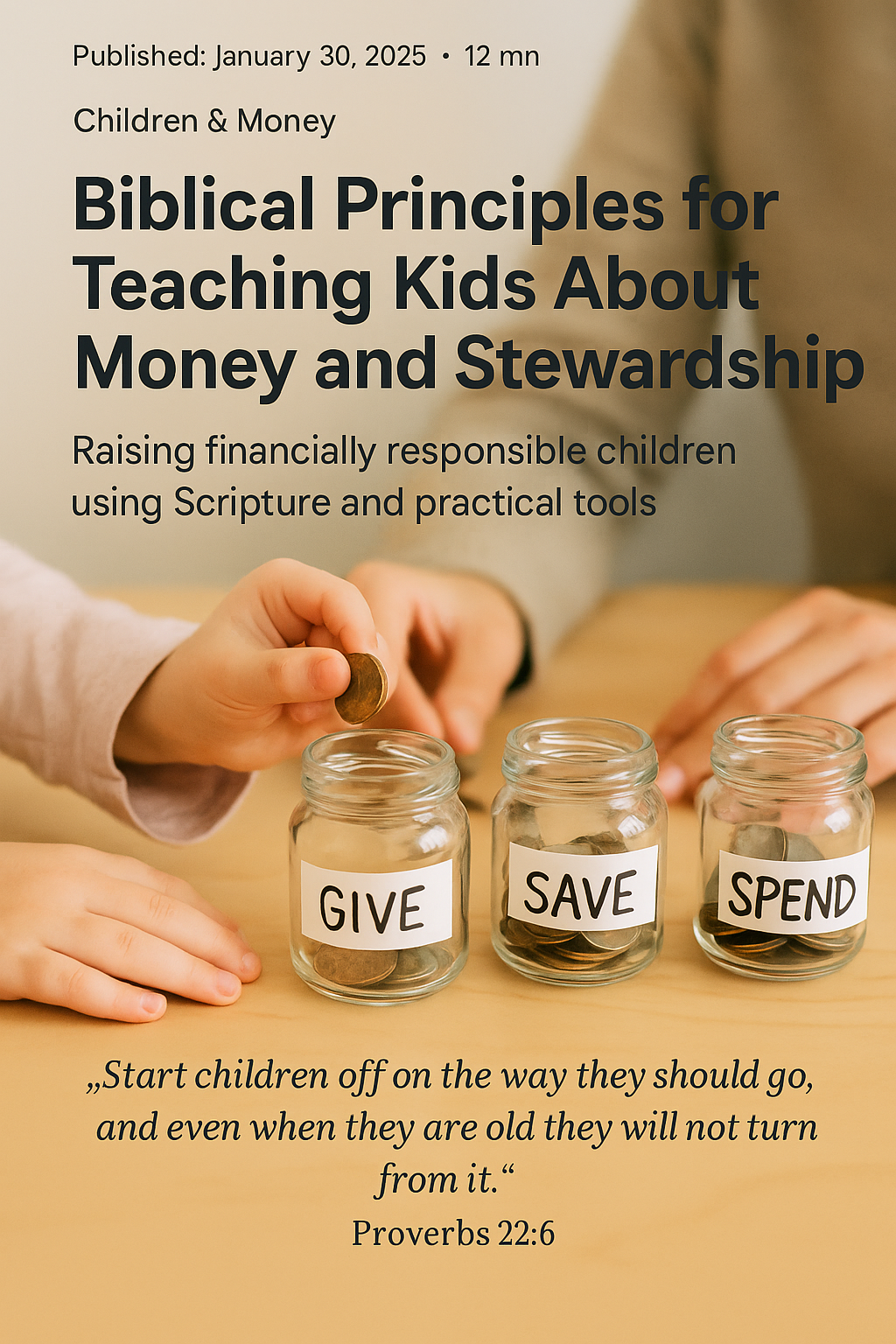

Eight-year-old Emma carefully counts her allowance money into three jars labeled "Give," "Save," and "Spend." Her mom watches as Emma puts the first dollar in the "Give" jar without hesitation. "God gets the first part," Emma explains matter-of-factly. This simple moment represents years of intentional biblical financial education that will shape Emma's relationship with money for life.

Teaching children about money isn't just about financial literacy – it's about heart transformation. When we ground financial education in biblical principles, we're not just raising kids who can balance a checkbook; we're raising future adults who understand stewardship, practice generosity, and find their security in God rather than wealth.

Biblical Foundation for Teaching Kids About Money

Scripture provides clear guidance about training children in financial matters:

Biblical Commands

- "Train up a child" - Proverbs 22:6

- "Teach them diligently" - Deuteronomy 6:7

- "Tell the next generation" - Psalm 78:4

- "Discipline your son" - Proverbs 19:18

- "Children's inheritance" - Proverbs 13:22

Biblical Values to Teach

- Stewardship: Everything belongs to God

- Generosity: It's more blessed to give

- Work ethic: Honest work is honorable

- Contentment: Godliness with contentment

- Wisdom: Planning and delayed gratification

Age-Appropriate Financial Education

Ages 3-6: Foundation Years

Young children learn through simple, concrete experiences. Focus on basic concepts and heart attitudes:

Ages 3-6: Core Concepts

Key Lessons

- God provides everything we need

- We should share with others

- Work is good and important

- We save money for things we want

- Some things cost money, some are free

Practical Activities

- Three-jar system: Give, Save, Spend

- Simple chores for small rewards

- Counting coins and bills

- Store visits to understand purchasing

- Piggy bank savings for special items

Biblical Stories

- Creation: God provides everything

- Manna: God gives daily bread

- Widow's mite: Giving from the heart

- Good Samaritan: Helping others with money

- Jesus and money: Basic teachings about giving

Memory Verses

- "God will supply all your needs" (Phil 4:19)

- "It is more blessed to give" (Acts 20:35)

- "God loves a cheerful giver" (2 Cor 9:7)

Ages 7-11: Building Years

Elementary school children can understand more complex concepts and begin practicing real financial skills:

Ages 7-11: Skill Development

Advanced Concepts

- Percentage giving: 10% to God first

- Earning vs. receiving: Work creates value

- Wants vs. needs: Distinguishing priorities

- Delayed gratification: Saving for bigger goals

- Comparison shopping: Getting good value

Practical Skills

- Age-appropriate job responsibilities

- Calculating percentages for giving

- Setting and tracking savings goals

- Making purchasing decisions

- Understanding price vs. value

Biblical Studies

- Joseph's planning: Saving for the future

- Proverbs 31 woman: Wise money management

- Parable of talents: Using abilities well

- Rich young ruler: Money isn't everything

- Zacchaeus: Money and heart change

Money Tools

- Allowance with giving requirements

- Savings account at bank

- Simple budgeting worksheets

- Charitable giving opportunities

- Family financial discussions

Ages 12-18: Application Years

Teenagers can handle sophisticated financial concepts and real-world application:

Ages 12-18: Real-World Practice

Complex Concepts

- Compound interest: Money growing over time

- Investment basics: Building long-term wealth

- Debt dangers: Credit and loan consequences

- Income planning: Career and education choices

- Tax basics: Government and money

Life Skills

- Part-time job management

- Checking account and debit card

- Car insurance and maintenance costs

- College financing planning

- Independent budgeting practice

Advanced Biblical Studies

- Ecclesiastes: Money and meaning

- 1 Timothy 6: Money and contentment

- Luke 12: Worry and trust

- Matthew 6: Treasures and heart

- Stewardship parables: Accountability

Preparation Tools

- College budget planning

- Investment account opening

- Credit education (without credit cards)

- Career planning with income research

- Mentorship with Christian adults

The Three-Jar System: Give, Save, Spend

One of the most effective tools for teaching biblical money management is the simple three-jar system that reinforces biblical priorities:

| Jar | Biblical Purpose | Percentage | Age-Appropriate Lessons |

|---|---|---|---|

| GIVE | Honor God first, help others | 10-20% | God deserves first and best, joy of giving, helping others |

| SAVE | Plan for future, prepare for opportunities | 10-30% | Delayed gratification, goal setting, future planning |

| SPEND | Meet needs and enjoy God's gifts | 50-80% | Wise choices, needs vs. wants, contentment |

Teaching Methods That Work

Modeling Biblical Money Management

Children learn more from what they see than what they hear. Model the financial behaviors you want them to develop:

- Visible giving: Let children see you giving tithes and offerings

- Budget discussions: Include age-appropriate children in family budget planning

- Wise spending: Demonstrate comparison shopping and thoughtful purchasing

- Generous spirit: Show joy in giving and helping others financially

- Contentment: Express gratitude for what you have rather than complaining about what you lack

Teachable Moments

Use everyday situations to reinforce biblical money principles:

- Grocery shopping: Teach price comparison, budgeting, and need vs. want decisions

- Charitable appeals: Discuss how to evaluate giving opportunities

- Family financial challenges: Age-appropriate discussions about trusting God during difficult times

- Windfall money: Practice the three-jar system with birthday money or found change

- Major purchases: Show the process of saving, planning, and wise decision-making

Hands-On Learning Experiences

Create opportunities for children to practice financial skills in safe environments:

- Family store: Set up pretend store to practice buying and selling

- Lemonade stand: Experience entrepreneurship, customer service, and profit/loss

- Savings challenges: Set family goals for specific purchases or charitable giving

- Investment games: Age-appropriate simulations of saving and compound growth

- Charity projects: Plan and execute family giving projects

Common Parental Mistakes to Avoid

Mistake: "Money is Bad"

Problem: Teaching that money itself is evil or unspiritual

Solution: Teach that money is a tool that can be used for good or evil

Mistake: "We Can't Afford It"

Problem: Teaching scarcity mindset and victim mentality

Solution: "We choose to spend our money on other priorities"

Mistake: No Financial Boundaries

Problem: Giving children everything they want without earning

Solution: Connect privileges to responsibilities and teach earning

Mistake: Avoiding Money Discussions

Problem: Leaving children to learn about money from peers and media

Solution: Proactively teach biblical money principles at every age

Building Work Ethic and Earning

Teaching children to work for money builds character and understanding of value:

| Age Range | Appropriate Work | Typical Payment | Character Lessons |

|---|---|---|---|

| 3-6 years | Simple chores, helping parents | $0.25-$1.00 per task | Work is good, helping family |

| 7-11 years | Regular chores, pet care | $1-$5 per week | Responsibility, consistency |

| 12-15 years | Yard work, babysitting | $5-$25 per job | Skills development, customer service |

| 16-18 years | Part-time jobs, business ventures | Minimum wage+ | Professional skills, work ethic |

Teaching Generosity and Giving

Generous giving is one of the most important financial habits to develop early:

Age-Appropriate Giving Opportunities

- Preschool: Putting money in church offering, buying food for food bank

- Elementary: Sponsoring a child, supporting missionaries, local charity projects

- Middle School: Organizing fundraisers, volunteer work combined with giving

- High School: Regular percentage giving from job income, researching effective charities

Making Giving Joyful

- Tell stories: Share how giving helps real people

- See results: Visit places your family supports

- Celebrate giving: Make giving occasions special and happy

- Give together: Family giving projects build shared values

- Express gratitude: Thank God for the privilege of giving

Your Family Financial Education Plan

30-Day Kids Money Challenge

Week 1: Assessment & Setup

- Assess what your children currently know about money

- Set up three-jar system (physical or digital)

- Establish age-appropriate chore/earning system

- Begin daily prayers thanking God for provision

Week 2: Biblical Foundation

- Teach one biblical money story appropriate for their age

- Practice the three-jar system with any money they receive

- Discuss family financial values and priorities

- Start involving kids in age-appropriate budget discussions

Week 3: Practical Application

- Plan and execute first giving opportunity

- Set savings goal for something they want

- Practice wise spending on a small purchase

- Use Family Hub to track progress

Week 4: Long-term Planning

- Create ongoing system for regular money education

- Plan quarterly family financial discussions

- Set up accountability for continued learning

- Celebrate progress and commitment to biblical stewardship

Long-Term Vision: Raising Financial Disciples

The goal isn't just raising kids who are good with money – it's raising future adults who see money as a tool for kingdom purposes and find their security in God rather than wealth.

"But as for you, continue in what you have learned and have become convinced of, because you know those from whom you learned it."

When you successfully teach biblical money principles to your children, you're investing in:

- Their future families: They'll pass these principles to their children

- God's kingdom: They'll use wealth to advance God's purposes

- Their security: They'll find peace in God's provision rather than money

- Their generosity: They'll live with open hands and generous hearts

- Their wisdom: They'll make financial decisions based on eternal values

The time you invest in teaching biblical money principles today will yield dividends for generations. Start where your children are, use age-appropriate methods, and trust God to use your faithful teaching to shape their hearts toward Him.